Metropolitan Funeral Plan

We are committed to giving your loved ones more time to celebrate your unique life. Get a personalised Metropolitan Funeral Plan that meets your needs.

We are committed to giving your loved ones more time to celebrate your unique life. Get a personalised Metropolitan Funeral Plan that meets your needs.

We are committed to giving your loved ones more time to celebrate your unique life. Get a personalised Metropolitan Funeral Plan that meets your needs.

If getting funeral cover is on your to-do list, we’ll help you get it done.

A customisable Metropolitan Funeral Plan gives you flexibility and makes planning for ‘what if’ easier and more affordable.

Cover starting from just R40 a month.

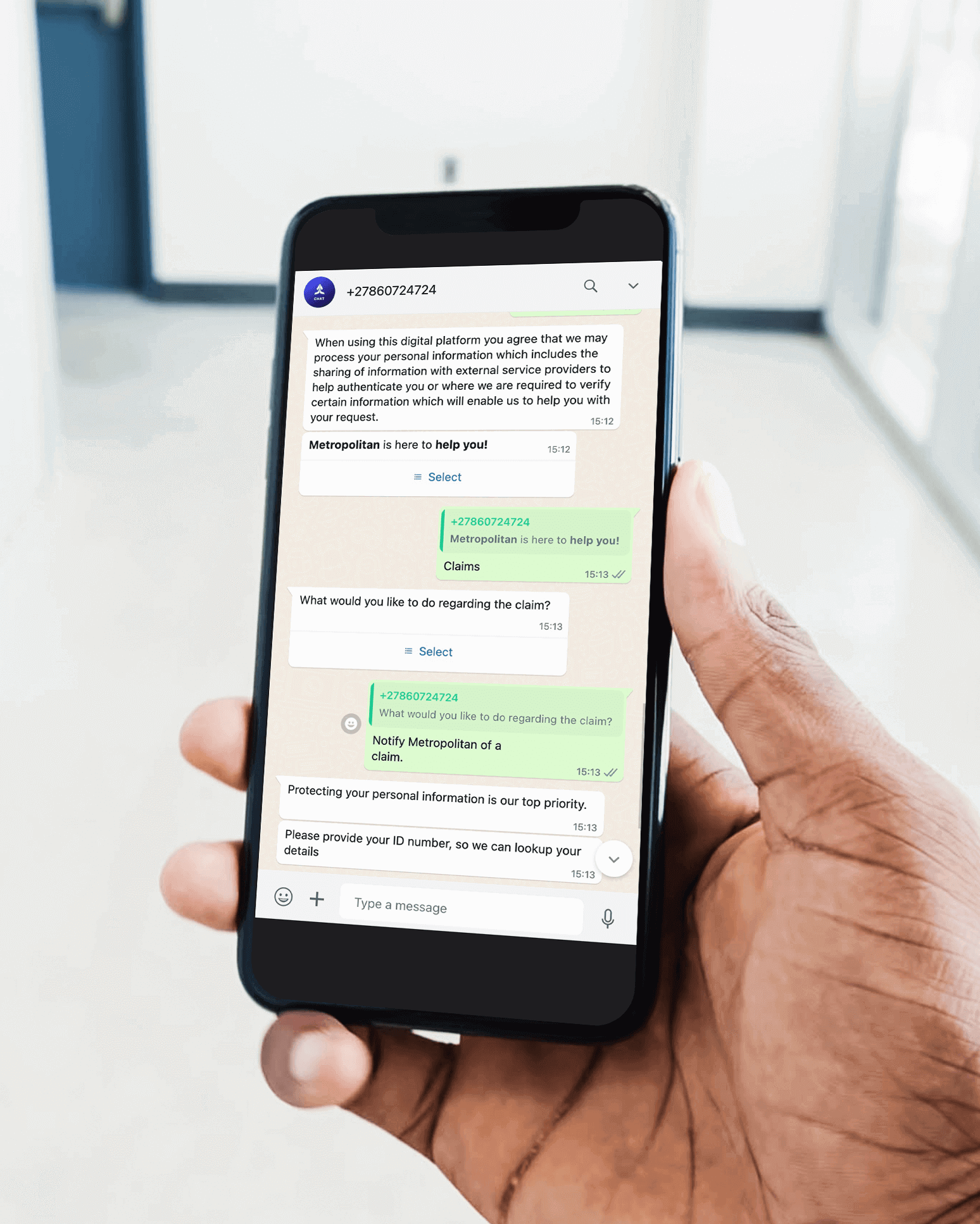

Claim via WhatsApp or online. Valid claims submitted via WhatsApp paid within 4 hours.

Cover up to 20 family members on one plan.

Cover yourself and immediate family for up to R100 000.

Cover your parents and extended family for up to R70 000.

Choose the Payment Protection benefits on death, disability and/or retirement and we'll cover the cost of your premiums when you become disabled, retire or pass away. A family member can take over the plan to ensure the plan continues.

Transportation of the deceased’s body. We’ll cover the cost to transport the deceased person’s body to the place of burial within South Africa. Ts & Cs apply.

Skip premiums in tough times. Even if you have to skip paying your premium, your plan still stays active. Ts & Cs apply.

Cover the rising cost of living (inflation). Add the Value Protection benefit to your plan to keep up with rising funeral costs.

Honour the memory of a loved one. Use the Memorial benefit to pay homage to the memory of a loved one, whether by choosing a tombstone or planning a memorial ceremony.

Cover for your immediate household needs. Choose the Monthly Essentials benefit to cover any shortfalls on your family’s living expenses as they adjust to the death of a loved one insured on the plan.

Choose the CashBack benefit and get some of your premiums back by staying on track with your plan. We'll give 12.5% of your premiums back to you after the first 24 months, and then every 36 months thereafter. Ts & Cs apply.

Claim via WhatsApp or online. Valid claims submitted via WhatsApp paid within 4 hours.

You can submit your claim:

Download the claim form via our online chat and follow the prompts. We encourage you to have all the supporting documents before submitting your claim.

We pay valid WhatsApp claims within 4 hours. Claims submitted via email, telephone or at a branch can take up to 48 hours to process. We’ll keep you updated along the way.

Funeral cover, or funeral insurance is there to take care of the immediate and often urgent costs of a funeral. It's a type of insurance which pays out a lump sum amount in the event of death, to help cover the costs of a funeral so that family members do not have to struggle financially at this difficult time.

The costs of a funeral can vary depending on your needs. The right funeral policy will provide cover not just for you, but for your whole family including your life partner and children. You can also take funeral cover for up to 20 people: parents and extended family members. At Metropolitan you can choose cover from R5 000 up to R100 000 to cater for your specific needs. The Metropolitan Funeral Plan offers affordable funeral cover from as little as R40 a month.

The Metropolitan Funeral Plan offers you and your family peace of mind knowing that you’re covered for a dignified funeral. Here’s some of the benefits you get with a Metropolitan Funeral Plan:

Cover your children

Choose whether to cover your children for life or for a limited time, up to age 21.

We'll take care of your premiums if you can’t

Choose the Payment Protection benefits on death, disability and/or retirement and we'll cover the cost of your premiums when you become disabled, retire or pass away. A family member can take over the plan to ensure the plan continues.

Get some of your premiums back

Choose the CashBack benefit and get some of your money back by staying on track with your plan. We will give 12.5% of your premiums after the first 24 months, and then every 36 months thereafter. Ts & Cs apply.

Transportation of the deceased's body (repatriation)

We'll cover the costs to transport the deceased person's body to the place of burial within South Africa. Ts & Cs apply.

Cover the rising cost of living (inflation)

Add the Value Protection benefit to your plan to keep up with the rising funeral costs.

Skip premiums in tough times

Even if you have to skip paying your premium when your finances are tight, having this benefit will ensure your plan still stays active.

We have developed a diverse service approach to ensure the claims process is easy and convenient when it matters most.

The Monthly Essentials benefit is an add-on benefit that pays a monthly payout of up to R3 000 for 6 or 12 months, depending on the cover you choose. You can claim and use the payout from the benefit to cover any household costs and other essential items after the death of an insured adult family member who contributed to your family’s income.

Ts & Cs apply.

This add-on funeral plan benefit pays a lump sum amount of up to R20 000 to help you honour the memory of a loved one. You could use the money to pay for a tombstone and/or a memorial ceremony. You can choose to receive the money immediately or within 18 months after you’ve made the funeral claim.

Ts & Cs apply.

To help make your funeral claim process as seamless as possible and ensure a fast payout, please include the following documents when submitting a funeral claim:

In the midst of the pandemic, I wanted to get my affairs in order. I made my daughter enter my details online, hoping someone would call me back to update my polices, which are almost 28 years old. I didn't have much hope. Until Sam from Metropolitan called me and assisted me over one weekend. He was professional and courteous. My only regret is that we did not cross paths sooner.

I seldom experience the kind of 5-star client service I received from Metropolitan, days after my beautiful mother passed from Covid complications. I can proudly say you treated me and those around me with dignity, love and respect. When I thanked the consultant, Alfred, he said "We are family". It felt like he was acknowledging my mother as his mother too. She would have loved that.

I had to face my father's death and was still in mourning when money owed to me was paid back. I had no energy to fight but the Metropolitan consultant came to my rescue. My family and I really appreciate all of your efforts. Keep doing what you're doing.

Unfortunately, my family lost a loved one during the pandemic. I assumed that remote working and increased workload would lead to an inefficient claims process. I was wrong. As tragic as our situation was, your office and Ms Pat Nzama provided superior service, which deserves to be appreciated and applauded. My family would like to thank Metropolitan for the quality service they provided in our time of need.

Close

You may request that your personal information held by Metropolitan be removed.

Please note that you will be contacted with regards to this request; as there may be other applicable laws that may prevent your data from being deleted.